Evaluate and Move into Medicare Advantage Plans: Save Hundreds with Insurance while you Get Started

Learning about Medicare Advantage Plans

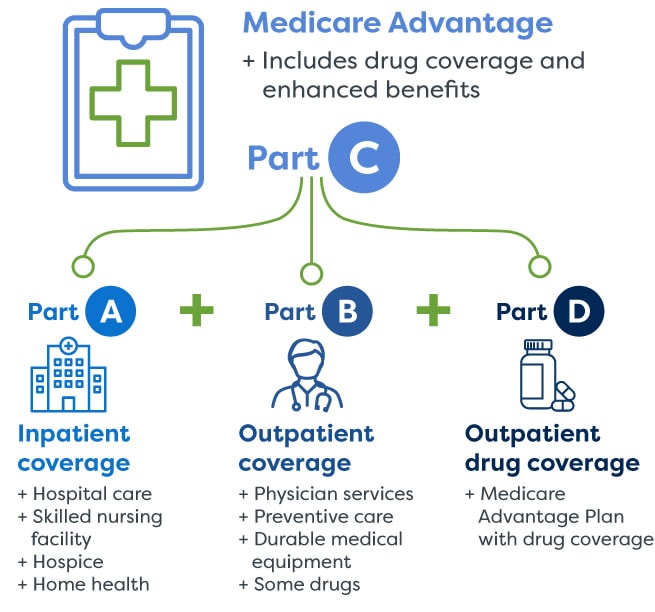

Medicare Advantage Plans function as offered by non-government Insurance companies that contract with Medicare to deliver Part A & Part B coverage in a single coordinated format. In contrast to Original Medicare, Medicare Advantage Plans often feature extra benefits such as prescription coverage, dental care, eye care services, plus health support programs. Such Medicare Advantage Plans run within specific geographic boundaries, making geography a critical element during evaluation.

Ways Medicare Advantage Plans Vary From Original Medicare

Original Medicare offers open provider availability, while Medicare Advantage Plans typically use Policy National Medicare Advantage Plan structured provider networks like HMOs plus PPOs. Medicare Advantage Plans may require provider referrals as well as in-network providers, but they commonly balance those constraints with predictable costs. For many enrollees, Medicare Advantage Plans provide a balance between affordability in addition to added benefits that Traditional Medicare alone does not typically deliver.

Who May want to Look into Medicare Advantage Plans

Medicare Advantage Plans appeal to individuals seeking organized healthcare delivery along with expected expense reductions under a single policy. Older adults living with chronic conditions frequently prefer Medicare Advantage Plans because connected care approaches simplify ongoing care. Medicare Advantage Plans can also interest individuals who desire bundled services without managing several additional plans.

Eligibility Guidelines for Medicare Advantage Plans

To enroll in Medicare Advantage Plans, enrollment in Medicare Part A in addition to Part B must be completed. Medicare Advantage Plans are open to most people aged 65 in addition to older, as well as under-sixty-five individuals with eligible disabilities. Enrollment in Medicare Advantage Plans is based on residence within a plan’s coverage region with timing aligned with authorized sign-up windows.

Best times to Enroll in Medicare Advantage Plans

Timing plays a vital role when enrolling in Medicare Advantage Plans. The Initial Enrollment Period surrounds your Medicare qualification milestone along with enables initial selection of Medicare Advantage Plans. Missing this timeframe does not automatically remove eligibility, but it does limit available options for Medicare Advantage Plans later in the year.

Annual in addition to Qualifying Enrollment Periods

Every fall, the Annual enrollment window gives enrollees to change, remove, and also enroll in Medicare Advantage Plans. Special Enrollment Periods are triggered when qualifying events happen, such as moving plus loss of coverage, making it possible for adjustments to Medicare Advantage Plans beyond the typical schedule. Knowing these windows ensures Medicare Advantage Plans remain available when circumstances change.

How to Evaluate Medicare Advantage Plans Properly

Reviewing Medicare Advantage Plans requires focus to factors beyond recurring premiums alone. Medicare Advantage Plans differ by network structures, annual spending limits, prescription lists, together with benefit conditions. A careful assessment of Medicare Advantage Plans helps aligning healthcare priorities with coverage models.

Costs, Benefits, along with Provider Networks

Recurring expenses, copays, not to mention annual limits all shape the overall value of Medicare Advantage Plans. Certain Medicare Advantage Plans include low monthly costs but higher out-of-pocket expenses, while others prioritize stable expenses. Provider access also differs, which makes it essential to check that chosen providers accept the Medicare Advantage Plans under evaluation.

Prescription Benefits plus Additional Benefits

A large number of Medicare Advantage Plans include Part D prescription coverage, easing medication handling. In addition to medications, Medicare Advantage Plans may cover wellness programs, transportation services, even over-the-counter allowances. Reviewing these features supports Medicare Advantage Plans match with everyday medical requirements.

Joining Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can occur online, by telephone, and through authorized Insurance professionals. Medicare Advantage Plans call for precise individual details in addition to confirmation of eligibility before coverage activation. Finalizing registration properly prevents delays in addition to unexpected coverage interruptions within Medicare Advantage Plans.

The Role of Licensed Insurance Agents

Authorized Insurance professionals assist explain plan details together with outline differences among Medicare Advantage Plans. Connecting with an expert can resolve provider network restrictions, coverage limits, in addition to expenses linked to Medicare Advantage Plans. Professional guidance often simplifies decision-making during enrollment.

Frequent Mistakes to Prevent With Medicare Advantage Plans

Missing doctor networks stands among the common errors when evaluating Medicare Advantage Plans. An additional problem involves concentrating only on premiums without considering overall expenses across Medicare Advantage Plans. Reading coverage documents thoroughly reduces misunderstandings after sign-up.

Reviewing Medicare Advantage Plans Every Coverage Year

Healthcare needs shift, with Medicare Advantage Plans change each year as part of that process. Reviewing Medicare Advantage Plans during open enrollment periods enables changes when coverage, costs, and/or providers shift. Regular evaluation ensures Medicare Advantage Plans consistent with current healthcare goals.

Why Medicare Advantage Plans Keep to Grow

Enrollment data demonstrate growing demand in Medicare Advantage Plans across the country. Expanded benefits, defined spending limits, and integrated care support the popularity of Medicare Advantage Plans. As offerings multiply, informed comparison becomes increasingly valuable.

Long-Term Benefits of Medicare Advantage Plans

For a large number of enrollees, Medicare Advantage Plans provide consistency through integrated benefits also organized care. Medicare Advantage Plans can minimize administrative burden while promoting preventative care. Selecting well-matched Medicare Advantage Plans builds assurance throughout later life stages.

Compare and Choose Medicare Advantage Plans Now

Making the right step with Medicare Advantage Plans begins by exploring available choices together with verifying qualification. If you are currently entering Medicare and/or revisiting existing coverage, Medicare Advantage Plans offer adaptable coverage options designed for diverse healthcare priorities. Compare Medicare Advantage Plans now to identify a plan that supports both your health and your budget.